Offered property collateral financing however, not knowing just how much security you currently have?

A home collateral mortgage is simple, if you’ve got the brand new guarantee so you’re able to back it up. And that is, the question isn’t are you presently recognized, but rather, just how much have you been permitted obtain?

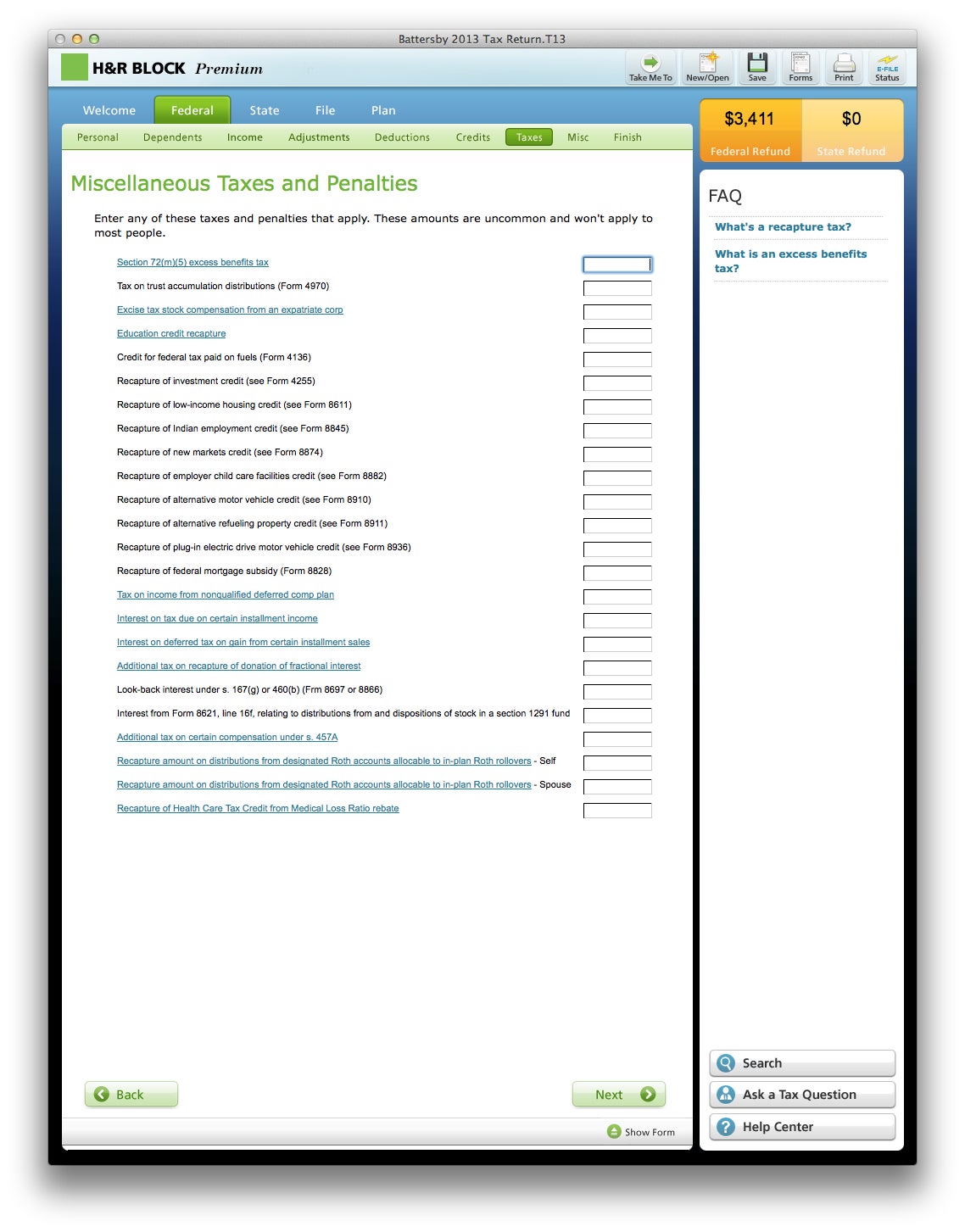

Before applying for a loan you will need to make certain you may have security on your own possessions. We written an easy on the internet house security calculator unit to provide you a concept of whatever you be eligible to acquire.

Family Collateral Online calculator Just what You will need

What you’ll want to estimate your residence guarantee is not hard to score. You will want a quotation of your own appraised property value your property and you may a summary of any outstanding mortgages (this consists of HELOC’s). Becoming we are merely trying regulate how far you meet the criteria in order to use, you won’t need to see your own home loan pricing or home loan repayments at this time. Concurrently, you will need to are one liens (i.age. Money Canada loans) registered facing your property. And, If you find yourself being unsure of when you yourself have an effective lien, a name research might be conducted to find out.

The simple domestic guarantee computation product really does the newest math for your requirements. Merely type in the house’s estimated value accompanied by per financial/lien and we’ll estimate simply how much equity you really have from inside the your property.

Second step Being qualified

If you have made it to that particular action, you can now submit your details and then click just how much was We eligible to acquire to find out exactly how much you may qualify for. Approvals shall be given within 24 hours, and we’ll assist you to know your needs, especially if you’ve been turned down to own borrowing from the bank someplace else.

Additionally, we can evaluate though you’ll qualify for a safeguarded home equity loan otherwise personal line of credit. Likewise, we could talk about techniques to help you lower your monthly installments and you will alter your credit score.

Less than perfect credit Timely Approvals

Luckily, we are not impeded like other large creditors. And, i’ve several lending products out-of each other organization and personal lenders who will be happy to overlook borrowing from the bank and you can earnings items.

Our on the internet domestic security loan approvals derive from the amount away from security of your house maybe not your revenue or credit history. Likewise, you don’t need to care and attention for those who have a history case of bankruptcy or individual offer.

In conclusion, the only big criteria lenders have a look at is the amount of guarantee you’ve got. Being qualified is equity-mainly based which means poor credit can not keep you back if you’ve had equity. We can help your improve your less than perfect credit rating which have property equity mortgage in order to consolidate higher-attract personal debt.

Collateral put as opposed to security leftover

After you have joined your numbers into our home equity calculator you will notice a club representing your security made use of instead of the brand new collateral you may have left. If you don’t have any security a poor amount look and the pub would-be complete. Alternatively, the more collateral you have the best, but despite minimal equity, you may still keeps possibilities.

Albeit, there is a large number of lenders advertisements as you are able to borrow around 90-95% of one’s property value your home. That said, most reputable loan providers does not exceed giving financing for more than 80-85% of their value.

Simply how much create I be eligible for?

features simplified the whole process of bringing approvals into the repaired-rate house equity finance. Most of the time, we can arrange for property owners to help you acquire doing 85% of the worth of their homes. Mainly because finance was recognized built primarily on your collateral, in lieu of credit otherwise money, they can be accepted and you can closed easily.

How about your house security personal line of credit (HELOC) choice?

Unfortunately, being qualified to have a good HELOC isn’t as as simple a collateral financing. A house collateral personal line of credit affairs within the things like borrowing from the bank and you can earnings. You will have to have shown better borrowing from the bank and you will earnings to be qualified. However,, you may still find lenders who don’t require best borrower.

Despite being harder so you’re able to qualify for, he could be indeed useful for folks who be considered. Whereas a house collateral financing is available in a lump sum payment a HELOC may be used identical to credit cards and also you pay only about what your use. At the same time, the speed is oftentimes far more compliant in addition to terms and conditions try slightly more versatile. Either way, utilising the equity of your home in order to combine personal debt is close to always a great way to save money.

Exactly what can we help you with?

Now you know the way much collateral you have, we could opinion your credit choices. At the we realize that each problem differs. Just after accepted, you need your property collateral financing to own an impressive selection off purposes:

- Debt consolidating consolidate their large-desire personal debt towards one to sensible percentage

- Family Home improvements create repairs or improvements to boost your house well worth

- Assets Tax Arrears catch up with the possessions income tax arrears to protect your residence

- Foreclosure stop a property foreclosure or fuel out-of product sales because of the making up ground into home loan arrears

- Canada Cash Obligations repay Money Canada loans and stop an income tax lien or garnishment

- Individual Proposition Payment finish/pay back https://paydayloancolorado.net/dove-creek/ an offer to change your credit score

If you guarantee, we’ve generated being qualified basic, easy, and easy. And we will let you know whenever you are recognized within 24 hours.

Leave a Reply